All posts by kingella723

Student debt crisis can change lives forever

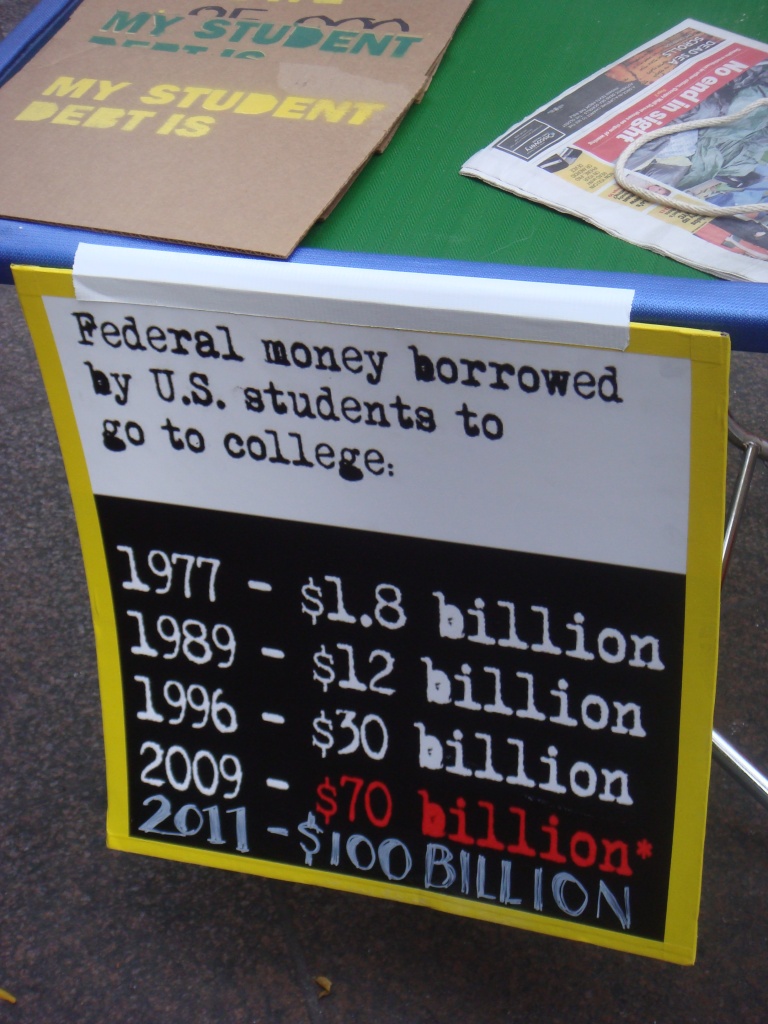

The United States of America is considered one of the greatest countries in the world. With that being said there are pros and cons to everything, one of the largest cons being adults between the ages of 18-30 is student debt. Within past generations college was viewed as a luxury rather than a normal good; this meaning as the country grew and changed the price of getting a degree and becoming a well-educated member of society has substantially increased. The United States’ national student debt crisis has caused a detrimental impact on the livelihood of college students and graduates between the ages of 18-and 30 that have taken out student loans within the past 20 years. The cost of living has had a spike within the past 50 years, this is no different when comparing the price of college 50 years ago to the price of college now. Basing student loans on the economic stability of the United States can have disastrous consequences on the cost of loans and the amount of interest that is included. But it is not all negative, there can be positive aspects to taking out student loans. As stated in Pros and Cons of Student Loans “Student loans, used responsibly, can help college students and graduates build their credit scores.”(Stobierski 2). But these credit scores are just one positive attribute of student loans, most of the other redeeming qualities are negative.

Life is expensive, that is a very simple concept for anyone to grasp. But adding in the factor of having to pay someone back on top of that can make living above the poverty line almost impossible. This idea isn’t just for college graduates but for college students as well. It’s completely normal to be broke in college but once you graduate you hope that maybe you’ll be able to keep more than $100 in your bank account. That indicated this isn’t the case for graduates that have student debt. The lingering debt after graduation can cause adults to take the first job that comes around because they can’t afford to waste time with more schooling or looking for a better-paying job. Graduates are in such a hurry to start paying their loans back so it doesn’t have an even more disastrous impact on their lives. Terri Williams wrote 10 Ways Student Debt can Derail your life, within this article, he states “For instance, the average starting salary for someone with an undergraduate degree in business administration was a little more than $57,000, according to the National Association of Colleges and Employers. Compare that to the entry-level earnings of someone with a master of business administration (MBA) at almost $85,000.”(Williams 1). A difference in salaries is just one example proving that student debt can derail your life without you even realizing it. Graduates with student debt have their arms twisted once they graduate, the hurry and rush to find a good job cause an extreme amount of stress and pressure on them. This causes them to start their life in a way that they do not desire.

work cited

Fry, Richard. “Section 1: Student Debt and Overall Economic Well-Being.” Pew Research Center’s Social & Demographic Trends Project, Pew Research Center, 31 Dec. 2019, https://www.pewresearch.org/social-trends/2014/05/14/section-1-student-debt-and-overall-economic-well-being/.

Williams, Terri. “10 Ways Student Debt Can Derail Your Life.” Investopedia, Investopedia, 8 Sept. 2021, https://www.investopedia.com/articles/personal-finance/100515/10-ways-student-debt-can-destroy-your-life.asp.

Download Limit Exceeded – Pennsylvania State University. https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.401.2486&rep=rep1&type=pdf.

Indebted, Kirsten. “Everything Finance.” Everything Finance, https://everythingfinanceblog.com/16008/student-loans-impact-life-after-college.html.

Stobierski, Tim. “Pros and Cons of Student Loans.” Student Debt Warriors, 3 July 2021, https://studentdebtwarriors.com/students/pros-and-cons-of-student-loans/.

“Stats about Student Debt.” Flickr, 21 Apr. 2022, https://flic.kr/p/aECjDk.

“F8med.Studentdebt.” Flickr, 21 Apr. 2022, https://flic.kr/p/5RjUQA.

Scholarly Source Summary

Title: Does student debt have an impact on financial health of a household?

Within this source the issue of student loans and short-term household financial help is one of the largest topics discussed. It then goes on to predict the living quality of those students who do have student debt. And to finish this source off it compares the students who have debt to those who don’t.

quotes: “Higher 2007 net worth, a four-year college graduate living in the household, being older, and being married have a significant positive association with 2009 net worth.”, “According to the Federal Reserve Bank of New York, about 2.2 mil- lion Americans 60 years of age or older were liable for repayment of $43 billion in federal and private student loans in 2012.”

link: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.401.2486&rep=rep1&type=pdf

Source Summary 2

10 ways student debt can derail your life

Summary: Looking at the millennial generation the author Terri Williams, discusses how their lives have been affected by the student debt crisis and how they have had such a large impact on the economic stability of the United States. The author then goes on to discuss how forgoing graduates school has had an impact on their lively hood and how they don’t have the same standard of living as other generations. and to finish the article Williams, says student debt never goes away and it never will. It is dependable on the upcoming generations to help revive and save the economy.

Quotes: “Before even considering taking out a loan, it’s essential to recognize the consequences of borrowing money and to be disciplined enough only to borrow what is needed.”, “When Equifax asked in 2015 millennial renters why they did not buy a home, 55.7% of respondents listed “student loan debt/not enough money saved” as the top reason.”

Source Summary

Link: https://www.businessinsider.com/why-is-the-student-debt-crisis-so-bad-4-reasons-2021-11

Summary: Within this article the main issues as to why the student debt crisis has become such a problem in the United States. The fact that parents take out loans to help their children through college is discussed thoroughly to exemplify that this crisis doesn’t just affect students. Said within the article “for example, is a 57-year-old parent who is now saddled with $550,000 in parent PLUS loans because he wanted to ensure his children would receive an education.”. The final point made is how this crisis has such a large impact on the economic stability why there has been such an increase within the past 13 years, as quoted in this article “”America has a consumer-driven economy,” Warren previously told Insider. “Knocking tens of millions of people out of being able to participate in that economy, taking money out of their pockets.”.

Descriptive title: 4 Reasons Why the Student Debt Crisis is so Bad

Social Justice Research link list

European Immigration Policy:A Comparative Study

How The Killings of Two Black sons ignited Social Justice Movements

https://www.cbsnews.com/news/charles-m-blow-trayvon-martin-and-the-black-lives-matter-movement/

Defining Social Justice and the Philosophy Behind it

https://www.calculemus.org/lect/FilozGosp04-05/novak.html

Do Something

https://www.dosomething.org/us

Social Justice and Social Movements

Rhetorical Analysis Article Information

Ella King

Thursday, February 10th, 2022

- The title of my article is Defund the police? Actually, police salaries are rising in departments across the United States. Hyperlink: https://theconversation.com/defund-the-police-actually-police-salaries-are-rising-in-departments-across-the-united-states-161977

- My article was published on June 29th, 2021 and was published through Vanderbilt University. The medium for my article is “The Conversation” from WordPress.com. The purpose of this article was to inform that public about the salary increase within police departments all over the United States. The intended audience was people that want the police departments to be defunded. This article was written by Laurie Woods, a senior lecturer at Vanderbilt University.

- The argument being made within this article is that police departments should not be having salaries increased due to standings in todays society. In the argument that is being made the author takes a stance in explaining just how much the police salaries all over the United States have increased, by providing factual and statistical evidence.

- Within this article ethos is used when the author brings up salary increases in the police department where Derek Chauvin ( the policeman who was responsible for the death of George Floyd) works. This is used because Woods is appealing to an ethical issue that has been publicized and brought light into how the United States police departments truly work. She then highlights logos when she compares the different salaries and overtime money throughout different states. With California and Alaska having the highest salaries. Woods appeals to logos with this information because she does take in the cost of living in these areas, which is an important factor in salaries. She then also touches on the overtime pay and how outrageous the amount is.