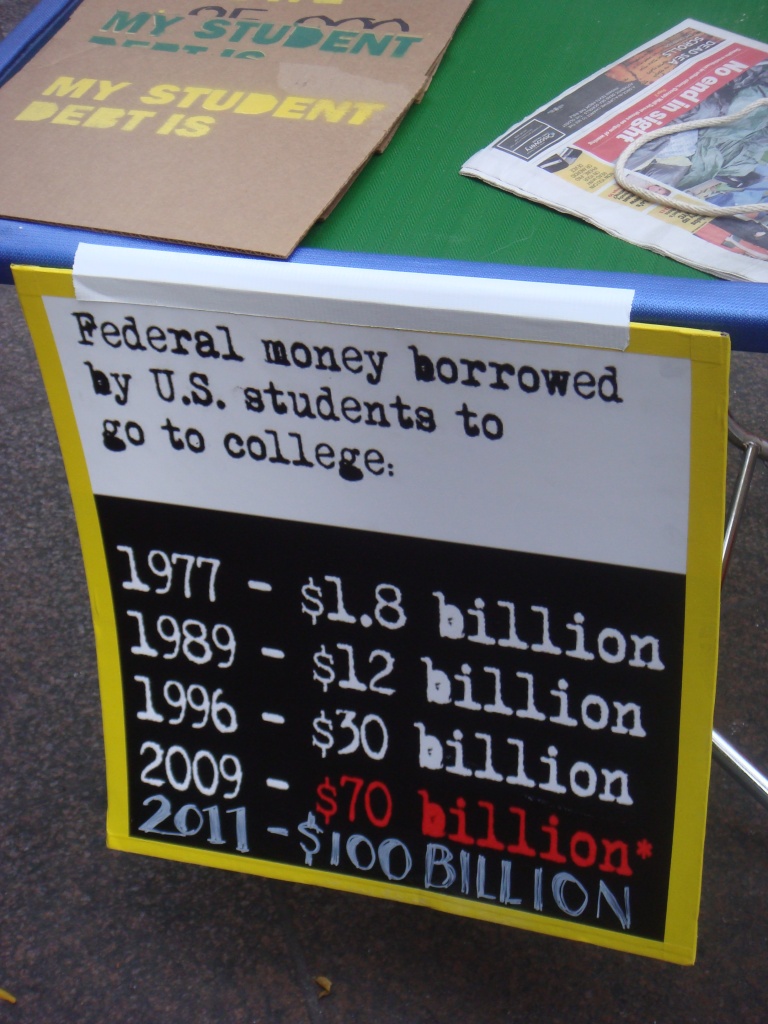

The United States of America is considered one of the greatest countries in the world. With that being said there are pros and cons to everything, one of the largest cons being adults between the ages of 18-30 is student debt. Within past generations college was viewed as a luxury rather than a normal good; this meaning as the country grew and changed the price of getting a degree and becoming a well-educated member of society has substantially increased. The United States’ national student debt crisis has caused a detrimental impact on the livelihood of college students and graduates between the ages of 18-and 30 that have taken out student loans within the past 20 years. The cost of living has had a spike within the past 50 years, this is no different when comparing the price of college 50 years ago to the price of college now. Basing student loans on the economic stability of the United States can have disastrous consequences on the cost of loans and the amount of interest that is included. But it is not all negative, there can be positive aspects to taking out student loans. As stated in Pros and Cons of Student Loans “Student loans, used responsibly, can help college students and graduates build their credit scores.”(Stobierski 2). But these credit scores are just one positive attribute of student loans, most of the other redeeming qualities are negative.

Life is expensive, that is a very simple concept for anyone to grasp. But adding in the factor of having to pay someone back on top of that can make living above the poverty line almost impossible. This idea isn’t just for college graduates but for college students as well. It’s completely normal to be broke in college but once you graduate you hope that maybe you’ll be able to keep more than $100 in your bank account. That indicated this isn’t the case for graduates that have student debt. The lingering debt after graduation can cause adults to take the first job that comes around because they can’t afford to waste time with more schooling or looking for a better-paying job. Graduates are in such a hurry to start paying their loans back so it doesn’t have an even more disastrous impact on their lives. Terri Williams wrote 10 Ways Student Debt can Derail your life, within this article, he states “For instance, the average starting salary for someone with an undergraduate degree in business administration was a little more than $57,000, according to the National Association of Colleges and Employers. Compare that to the entry-level earnings of someone with a master of business administration (MBA) at almost $85,000.”(Williams 1). A difference in salaries is just one example proving that student debt can derail your life without you even realizing it. Graduates with student debt have their arms twisted once they graduate, the hurry and rush to find a good job cause an extreme amount of stress and pressure on them. This causes them to start their life in a way that they do not desire.

work cited

Fry, Richard. “Section 1: Student Debt and Overall Economic Well-Being.” Pew Research Center’s Social & Demographic Trends Project, Pew Research Center, 31 Dec. 2019, https://www.pewresearch.org/social-trends/2014/05/14/section-1-student-debt-and-overall-economic-well-being/.

Williams, Terri. “10 Ways Student Debt Can Derail Your Life.” Investopedia, Investopedia, 8 Sept. 2021, https://www.investopedia.com/articles/personal-finance/100515/10-ways-student-debt-can-destroy-your-life.asp.

Download Limit Exceeded – Pennsylvania State University. https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.401.2486&rep=rep1&type=pdf.

Indebted, Kirsten. “Everything Finance.” Everything Finance, https://everythingfinanceblog.com/16008/student-loans-impact-life-after-college.html.

Stobierski, Tim. “Pros and Cons of Student Loans.” Student Debt Warriors, 3 July 2021, https://studentdebtwarriors.com/students/pros-and-cons-of-student-loans/.

“Stats about Student Debt.” Flickr, 21 Apr. 2022, https://flic.kr/p/aECjDk.

“F8med.Studentdebt.” Flickr, 21 Apr. 2022, https://flic.kr/p/5RjUQA.